Healthcare is shifting, with consumers taking a more active role in choosing and managing their health insurance. The 2024 HealthEdge® Consumer Survey offers valuable insights into these changing dynamics, revealing what matters most to today’s healthcare consumers.

Here are the key highlights from the survey and what they mean for health insurance brokers.

Brokers as Trusted Advisors in a Changing Market

The 2024 Healthcare Consumer Survey shows that today’s consumers want more transparency, convenience, and personalization from their health plans.

Brokers are in a unique position to help clients navigate these evolving expectations. Whether it’s offering plans with better digital tools, emphasizing preventative care, or simplifying cost transparency, brokers who can meet these demands thrive in the changing healthcare landscape. Brokers can build stronger relationships and ensure client satisfaction well into 2024 and beyond by positioning themselves as trusted advisors who help clients make informed and personalized decisions.

High Satisfaction with Room to Improve

The survey shows that 69% to 86% of consumers are satisfied with their health plans, especially those enrolled in Medicare Advantage or Dual-eligible programs. Younger, healthier individuals also report higher satisfaction.

However, satisfaction isn’t universal. Only 25% of respondents are fully satisfied with their health plan’s clarity in explaining costs. This presents an opportunity for brokers to help clients understand their plans better, especially regarding cost transparency.

Brokers who simplify coverage details and explain out-of-pocket costs gain a competitive edge.

Cost Transparency Is Crucial

While lower premiums and out-of-pocket costs remain important, consumers increasingly seek transparency in healthcare expenses. Only a quarter of respondents say their plans offer enough clarity around medical costs, signaling a major area for improvement. This trend supports the growing popularity of plans like UnitedHealthcare’s Surest product, which provides cost clarity upfront.

Brokers who offer solutions emphasizing transparency and financial clarity likely attract clients frustrated by surprise medical bills or unclear pricing structures.

Embracing Digital Tools

A notable 65% of consumers are comfortable using digital tools like mobile apps and AI-powered services to interact with their health plans. This marks a significant shift, showing that even older populations are becoming more comfortable with technology.

For brokers, this means that tech-enabled health plans and brokerages are becoming the norm. Consumers now expect the same digital convenience in healthcare that they experience in other aspects of life. By partnering with health plans that offer user-friendly digital solutions, brokers can appeal to tech-savvy clients who want to manage their healthcare on the go.

Personalized and Proactive Healthcare is In Demand

Today’s healthcare consumers want a more personalized and proactive experience. The survey shows that 60% of respondents prioritize preventive care and early intervention, and 49% want a proactive approach to managing their health. Additionally, 46% of consumers seek easier access to information and streamlined communication with their health plans.

Brokers can leverage these insights by offering plans that emphasize preventive care and personalized health management. Clients are no longer content with reactive care—they want plans that help them stay healthy and avoid costly interventions.

Care Coordination is Important but Needs Improvement

Care coordination plays a crucial role in member satisfaction. Those with care managers report higher satisfaction, but only 36% are fully satisfied with the care they receive. Members want care managers to provide more individualized and comprehensive support.

For brokers, this means emphasizing the value of care coordination, particularly for clients with complex health needs. Helping clients understand how care managers can support them and their employees with medication management and care planning builds trust and satisfaction.

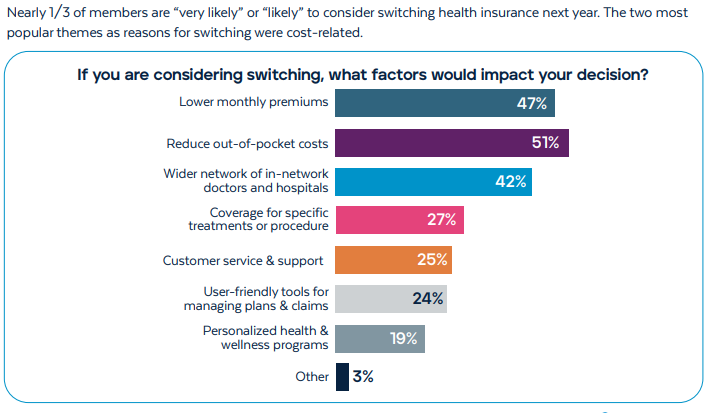

Plan Switching Is a Real Possibility

Nearly one-third of respondents consider switching health plans within the next year, especially those with individual or employer-sponsored coverage. This indicates that loyalty is not guaranteed, and brokers need to stay proactive to retain clients.

Brokers can reduce churn by staying engaged year-round, not just during open enrollment. Checking in with clients, addressing concerns, and offering new plan options when appropriate help build long-term relationships and prevent clients from seeking alternatives.

Technology as a Driver of Future Healthcare

Technology is shaping healthcare with platforms that offer real-time access to data, one-click referrals, and personalized care plans, helping streamline care coordination and reduce administrative burdens.

understanding how modern technology can improve client experiences is key for brokers. Offering plans that integrate these digital tools not only simplifies healthcare management for clients, but also positions brokers as forward-thinking advisors.

Reach out to your Amwins Connect Regional Sales Manager to support your critical role in helping clients access plans that truly meet their needs, delivering value through personalized, proactive service.