Reporting PCORI Fees to the IRS

May 2024

Fully insured carriers and most self-insured health plan sponsors must pay annual Patient Centered Outcomes Research Institute (PCORI) fees to the IRS. They are also required to report the same on Form 720 as an excise tax. The payment is due by July 31, 2024.

The PCORI Fee was to cease for plan years ending after September 30, 2019. However, the PCORI Fee regulation has been extended for another 10 years through September 30, 2029, due to the Consolidated Appropriations Act of 2020. (Internal Revenue Code Sections 4375 and 4376)

When Did This Requirement Start?

On December 6, 2012, the IRS issued final regulations on the annual payment of the PCORI Fees by fully insured carriers and self-insured plan sponsors of applicable health plans, including those covering retirees and COBRA individuals. (Internal Revenue Code Sections 4375 and 4376). Since July 2013, the fully insured carriers and most plan sponsors of self-insured health plans have been responsible for paying the annual fees directly to the IRS.

What are Applicable Health Plans and Excepted Benefits?

An applicable health plan is a self-insured health plan that provides for accident and health coverage. There are exceptions for excepted benefits.

- Excepted benefits: Includes separate dental and vision plans, health flexible spending arrangements, hospital indemnity plans, and disability income insurance, for example.

How do PCORI Fees Apply to Different Health Plans?

HRAs & Self-Insured Plans – A Health Reimbursement Arrangement (HRAs) that is integrated with a self-insured health plan is considered part of a single plan, which avoids duplication of fees.

HRAs & Fully Insured Plans – When the HRA is integrated with a fully insured medical plan, the employer plan sponsor submits payment for all employees enrolled in the HRA. The insurer (carrier) submits payments for the same employee who is enrolled in the associated insured plan. Employees only (not dependents) are counted towards calculating the PCORI fees for the HRA that’s integrated with a fully insured medical plan.

FSAs – A Health Flexible Spending Account (FSA) is not subject to the PCORI Fee if it meets the requirements of an excepted benefit under Code §9832(c). A health FSA is considered an excepted benefit if:

- The employers make other group health plan coverage (not limited to excepted benefits) available to employees for the year; and

- The health FSA is structured so that the maximum benefit payable to any participant cannot exceed two times the participant’s salary reduction election for the arrangement for the year (or, if greater, cannot exceed $500 plus the amount of the participant’s salary reduction election).

The IRS has published a chart that describes more information on the different types of plans subject to the fee.

What are the PCORI Fee Amounts? IRS Notice 2023-70

- $3.00 per covered life for plan years ending on or after October 1, 2022 through September 30, 2023 – Filing date July 31, 2024

- $3.22 per covered life for plan years ending on or after October 1, 2023 through December 31, 2023 – Filing date July 31, 2024

- $3.22 per covered life for plan years ending on or after January 1, 2024 through September 30, 2024 – Filing date July 31, 2025

Are There Penalties for Not Reporting?

The PCORI rules do not contain a specific penalty for failure to report or pay the PCORI fee, but since this fee is considered an excise tax, any related penalty for failure to file a return or pay a tax would seem to apply. Code §6651 includes the penalties for failure to file a return or pay taxes.

- The penalty is 5% of the excise tax due for each month or part of a month the return is late, with a cap of 25% of the unpaid tax. However, the minimum penalty for failure to file within 60 days of the due date, including extensions, is the lesser of $100 or the amount of tax owed with the return.

- There is also a penalty for failing to pay the excise tax on time. It is equal to .5% of any tax not paid by the due date for each month or part of a month the tax remains unpaid, up to 25% of the unpaid tax.

- On top of the penalties, interest can be charged on unpaid excise taxes. In some cases, penalties may be waived if the plan sponsor has reasonable cause and the failure to pay was not due to willful neglect.

How are Covered Lives Counted In Funded Health Plans?

- Actual Count Method – The plan sponsor adds the total number of lives covered (all covered lives, not just enrolled employees) for each day of the plan year and divides that total by the number of days in the plan year.

- Snapshot Method – The plan sponsor adds the total number of lives covered on a specified date (see below) during the first, second, or third month of each quarter of the plan year and divides the total by the number of dates on which the count was made. Each date used for the second, third, or fourth quarter must be within three days of the date used in the first quarter.

- Form 5500 Method – This method is based on the number of participants reported on Form 5500. This method can be used only if Form 5500 is filed no later than the due date of the PCORI Fee (July 31). If an extension is used resulting in Form 5500 being filed later than July 31, this method cannot be used to calculate the average number of covered lives.

Important to Remember Notes About PCORI Fees

- Fees are paid annually

- Fees are reported and paid by July 31 of each calendar year immediately following the last day of the plan year

- The total due each year is calculated by multiplying the average number of covered lives by the dollar amount for the Federal fiscal year in effect on the last day of the plan year

- Fees are paid using IRS Form 720 – Quarterly Federal Excise Return (due July 31st of each year)

- The fee cannot be paid from plan assets

- The fee cannot be submitted by a third party on a plan sponsor's behalf

- The fee is not tax-deductible

- Fully Insured carriers are responsible for paying the PCORI fees and reporting for fully insured health plans

- Self-Insured plan sponsors are responsible for paying the PCORI fees and reporting on IRS Form 720. The count will include employees and dependents.

- Plan sponsors offering an HRA benefit with their fully Insured health plan are responsible for paying the PCORI fees and reporting on IRS Form 720 for employees only enrolled in the HRA

- The PCORI fee do not apply to health FSAs or HSAs (which are not considered group health plans)

- PCORI fees and reporting are due based on the plan year

How Does the Employer/Plan Sponsor Report the Fees?

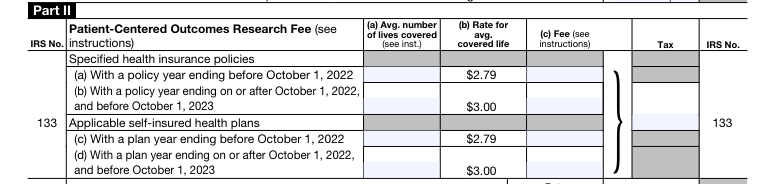

On the IRS Form 720, the information will be recorded in Part II on Page 2; IRS No. 133 – Applicable self-insured health plans (c) or (d) based on when the plan year ended.

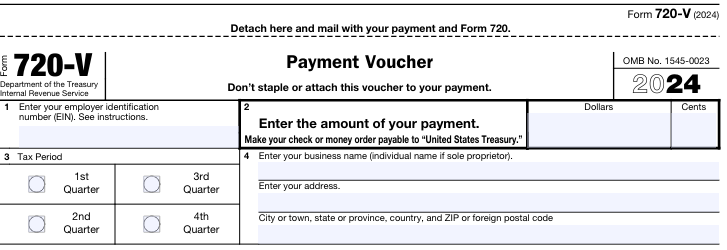

Also, the Payment Voucher, at the end of the form, must be completed. The 2nd Quarter box should be checked.

What Are The Carriers and TPAs Doing to Assist?

Aetna - Aetna has a PCORI Tax Estimator to help calculate the fee.

Cigna - Cigna's information on Fees and Taxes.

Sisco Benefits - Level Funded Healthy Advantage Plans - Sisco Benefits will send a communication piece to brokers and clients explaining when they can expect PCORI Fees to be available. PCORI Fee information will be posted on Sisco Connect.

United Healthcare – February 1, 2024, UHC posted information for Fully insured groups and ASO Groups including Level Funded groups.

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice or services. Readers should always seek professional advice before entering into any commitments.