Selected States’ Regulation of Pharmacy Benefit Managers

US GAO – Government Accountability Office found the following and published their findings back in March of this year.

What GAO Found

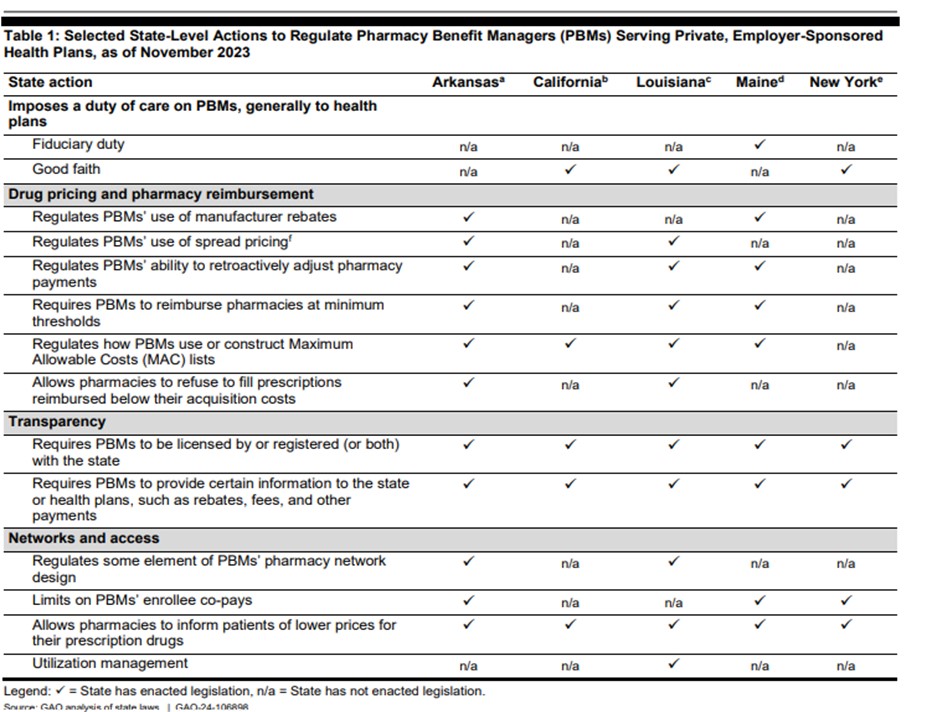

Private health plans contract with pharmacy benefit managers (PBM) to administer their prescription drug benefits and help control costs. Each of the five states selected for review—Arkansas, California, Louisiana, Maine, and New York—enacted a variety of laws to regulate PBMs.

- Fiduciary or other “duty of care” requirements. Four of the five states (California, Louisiana, Maine, and New York) enacted laws to impose a duty of care on PBMs. The laws varied from imposing a fiduciary duty—that is, a requirement to act in the best interest of the health plan or other entity to which the duty is owed—to what state regulators described as “lesser” standards such as a requirement to act in “good faith and fair dealing.”

- Drug pricing and pharmacy reimbursement requirements. The five states enacted a variety of laws relating to drug pricing and pharmacy payments, such as laws limiting PBMs’ use of manufacturer rebates and their ability to pay pharmacies less than they charge health plans—a practice referred to as “spread pricing.”

- Transparency, including licensure and reporting requirements. To increase the transparency of PBM operations, the five states enacted laws that require PBMs to be licensed by or registered with the state, or both, and to report certain information such as drug pricing, fees charged, and the amounts of rebates received and retained.

- Pharmacy network and access requirements. The five states also enacted laws regarding pharmacy networks and patient access. Examples include laws prohibiting discrimination against unaffiliated pharmacies and limiting patient co-pays charged by PBMs.

The regulators GAO interviewed from selected states described lessons learned regarding PBM regulation. Examples include the following.

- Regulators in four states said that providing regulators with broad regulatory authority was more effective than enacting specific statutory provisions. Doing so allowed regulators to address emerging issues without new legislation, according to regulators from one state.

- Some regulators also stressed the need for robust enforcement of PBM laws and effective penalties to enforce them. Two pharmacy associations GAO interviewed concurred with these views, while a health plan association said that monitoring is needed to ensure compliance with PBM requirements. Three regulators also said that clear reporting requirements and definitions helped ensure consistent enforcement.

The Department of Labor provided technical comments on a draft copy of this report, which GAO incorporated as appropriate.

Below chart is on page 20 of the 39 page report from the GAO.

Note: In addition to these laws that directly regulate PBMs, selected states may regulate the prescription drug benefits offered by health plans. To the extent health plans contract with PBMs to deliver such prescription drug benefits, PBMs may also be required to adhere to those requirements. However, laws regulating health plans’ prescription drugs benefits are beyond the scope of this report.

- Arkansas officials told us that except for the MAC list provision, they do not enforce PBM laws against PBMs that only serve self-insured plans.

- California officials told us their PBM laws do not apply to PBMs serving self-insured plans.

- Louisiana officials told us their PBM laws do not specifically address self-insured plans.

- Maine officials told us the only PBM laws that apply to PBMs serving self-insured plans are the licensing and reporting requirements.

- New York officials told us their PBM laws apply to all PBMs, regardless of the type of plan they serve.

- Spread pricing is a practice in which PBMs reimburse pharmacies at one rate and charge plans a different rate, retaining any positive difference as revenues.

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice or services. Readers should always seek professional advice before entering into any commitments.