ACA Health Insurance Subsidies Could Expire at the End of 2025

Resource for this article is from the Kaiser Family Foundation (KFF) website.

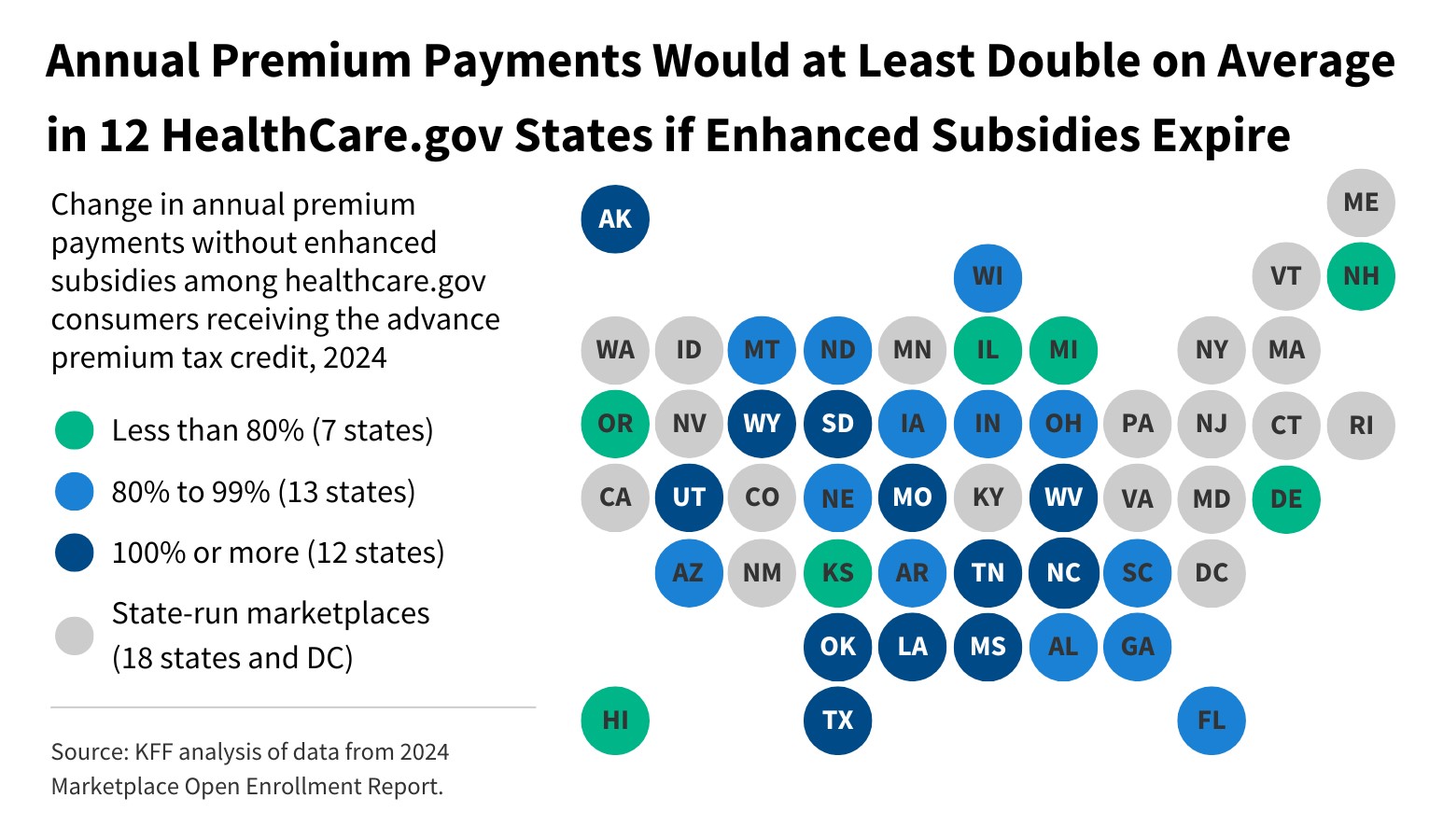

The effect of the subsidies expiring would be enrollees in the HealthCare.gov states could see annual payments at least double on average.

Without the enhanced subsidies in the Inflation Reduction Act (IRA), Affordable Care Act (ACA) Marketplace enrollees in the states that use HealthCare.gov would see their annual premium payments at least double on average, according to a new KFF Analysis.

Enrollees in three states would see the steepest annual increases and premiums would rise by an average of 93% or $624 overall in HealthCare.gov states.

If the subsidies do expire, KFF’s analysis finds that:

- The recent growth in ACA Marketplace plan enrollment has been driven primarily by low-income people, with signups by people with incomes up to 2.5 times poverty growing 115% since 2020.

- Enhanced subsidies have cut premium payments by an estimated 44% ($705 annually) for enrollees receiving premium tax credits. If the subsidies expire, most Marketplace enrollees will see premium payment increase substantially.

- Without these enhanced subsidies, premiums would double or more, on average, for subsidized enrollees in 12 states using Healthcare.gov.

The results of the 2024 elections will likely play a major role in whether the enhanced subsidies are extended beyond 2025. Nationally, enhanced subsidies have cut premium payments by an estimated 44% ($705 annually) on average for people receiving a subsidy. If they expire, almost all subsidized ACA Marketplace enrollees, including those in state-run marketplaces, would experience steep increases in premium payments in 2026. Because enhanced subsidies have made Marketplace coverage more affordable for low- and middle-income people, they would be the most impacted by a potential subsidy expiration.

Enrollees with low incomes would see the greatest jump in their premium payments. For example, a 45-year-old enrollee earning $25,000 on average would pay 573% ($917) more annually for a benchmark silver plan (from $160 with enhanced subsidies to $1,077 without them).

The number of people with Marketplace coverage nearly doubled since the enhanced subsidies began in 2021, from 11.4 million in 2020 to 21.4 million in 2024.

- This enrollment growth has been concentrated among low-income individuals, spurred by the availability of low-cost (and in some cases, zero-premium) plans made available by the enhanced subsidies.

- Zero-premium plans are available to a larger share of ACA Marketplace enrollees in the 10 states that have not expanded Medicaid.

- Among states that use HealthCare.gov, enrollees in Florida and Texas received the most ($2.2 and $1.5 billion respectively) in enhanced IRA subsidies in 2024.

Consequences for Employers

The prospect of PTCs (Premium Tax Credit) going away after 2025 would increase healthcare costs but would remove a notable compliance hurdle for employers.

While expanded PTC eligibility benefits employees and their families, it also raises compliance risks for employers. PTCs serve as triggers for the IRS to identify potential ACA non-compliance.

When an employee receives a PTC from a state or federal health exchange, the IRS cross-references the request with the employer’s ACA filings to identify organizations that may not be compliant with the ACA’s Employer Mandate.

Source Kaiser Family Foundation

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice or services. Readers should always seek professional advice before entering into any commitments.